US regulators have warned banks about the risks linked with the cryptocurrency market for the first time ever in a joint statement.

Financial institutions were warned by the watchdogs to look out for potential fraud, legal uncertainty, and deceptive statements made by companies dealing in digital assets.

Banks were also warned about the industry’s “contagion danger.”

It happens just two months after the bankruptcy of the trading site FTX rocked the cryptocurrency sector.

The US Federal Reserve, Federal Deposit Insurance Corporation, and Office of the Comptroller of the Currency stated in a joint statement that they were closely observing the cryptocurrency activity of banking institutions.

According to the statement, “the last year’s events have been characterized by high volatility and the exposing of weaknesses in the crypto-asset industry.”

The regulators added that it was “very likely” that issuing or retaining crypto tokens, which are kept on open, decentralized networks, would be at odds with safe and sound banking standards.

Additionally, banks were urged to take action to stop issues with the digital asset market from affecting the rest of the financial system.

It said, “It is crucial that risks associated with the cryptoasset sector that cannot be regulated or mitigated do not move to the financial system.”

The announcement on Tuesday comes after US financial sector watchdogs had been reluctant for months to give consistent recommendations on cryptocurrencies, despite banks’ requests for clearer guidance from authorities.

Shock FTX

The November fall of FTX shook the cryptocurrency market.

Millions of people entered the market for digital assets through it, which was the second-largest bitcoin exchange in the world.

Sam Bankman-Fried, the former CEO of FTX, formally refuted allegations that he had misled investors and consumers on Tuesday.

In a US court, he entered a not guilty plea to charges that he used consumer deposits at FTX to fund his other business, Alameda Research, as well as to purchase real estate and give to political campaigns.

Two of Mr. Bankman-closest Fried’s associates have already entered guilty pleas and are helping with the probe, which has shook the cryptocurrency market as a whole.

One of the most prominent individuals in the industry, Mr. Bankman-Fried was well-known for his political connections, celebrity endorsements, and bailouts of other faltering businesses.

He has been charged by the US with “erecting a house of cards on a foundation of deceit while convincing investors that it was one of the safest buildings in crypto,” according to the US.

Pope Francis dies aged 88 just hours after meeting JD Vance

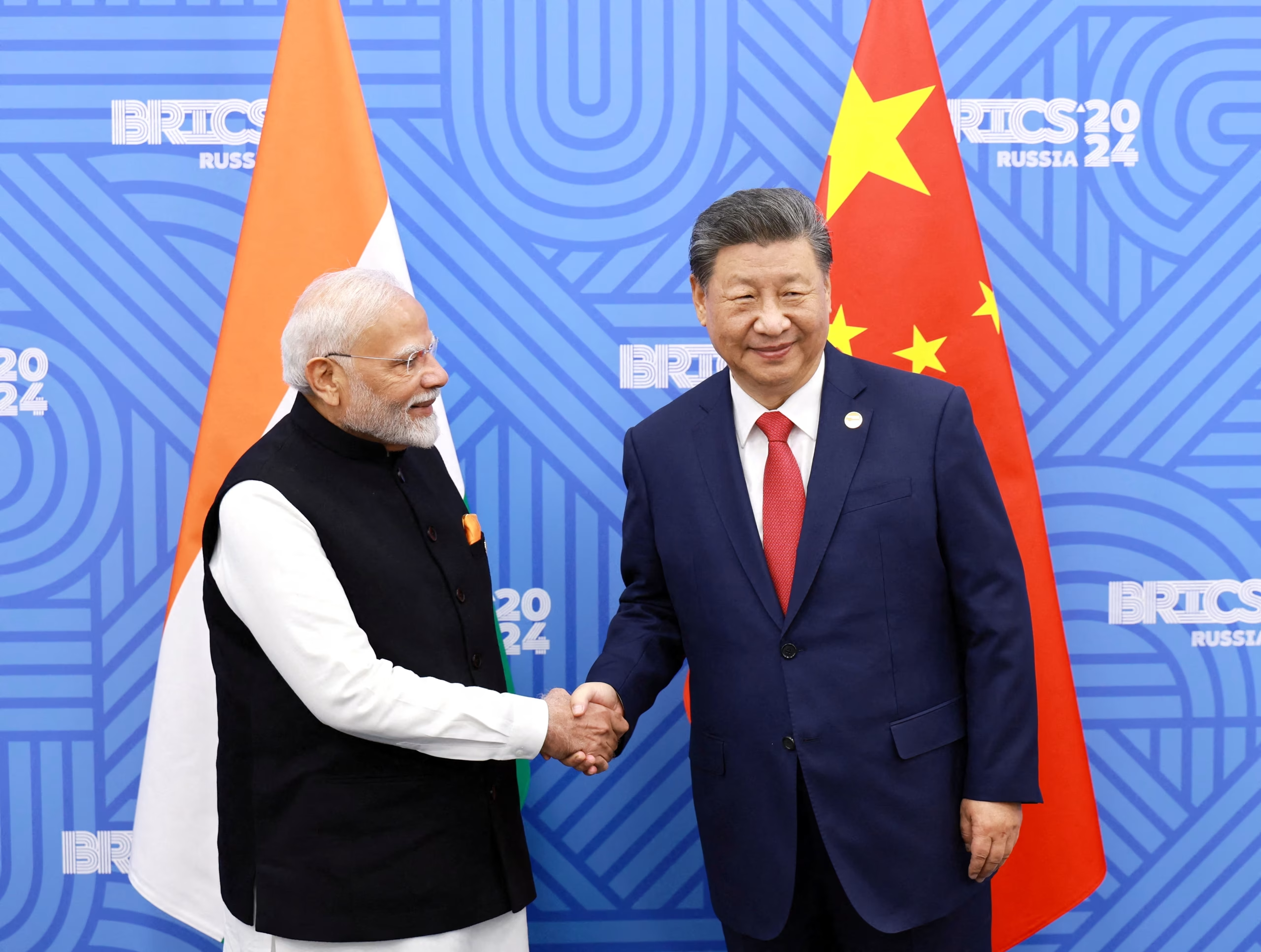

Pope Francis dies aged 88 just hours after meeting JD Vance India Signals Readiness to Pursue Stronger, Strategic China Business Ties After Border Dispute Resolution

India Signals Readiness to Pursue Stronger, Strategic China Business Ties After Border Dispute Resolution South Korea’s president Yoon Suk Yeol faces calls to resign

South Korea’s president Yoon Suk Yeol faces calls to resign South Korea troops try to storm parliament after martial law declared

South Korea troops try to storm parliament after martial law declared Indian police arrest seven for breaking into Bangladesh consulate

Indian police arrest seven for breaking into Bangladesh consulate Saudi Arabia’s MBS takes up new Middle East crises in UAE visit

Saudi Arabia’s MBS takes up new Middle East crises in UAE visit President Joe Biden grants full unconditional pardon to son Hunter

President Joe Biden grants full unconditional pardon to son Hunter Justin Timberlake drops big news about his Forget Tomorrow World Tour

Justin Timberlake drops big news about his Forget Tomorrow World Tour Vladimir Putin warns of using all weapons if Ukraine acquires nuclear arms

Vladimir Putin warns of using all weapons if Ukraine acquires nuclear arms Donald Trump warns BRICS nations of 100% tariffs over plans against US dollar

Donald Trump warns BRICS nations of 100% tariffs over plans against US dollar